Emerson Highlights Strategy for Engineering the Autonomous Future at 2025 Investor Conference

2025 Net Sales

Of sales spent on innovation in 2025

Employees

Year history

As of Sept. 30, 2025 • 10-K 2025

For complete information regarding our financials, see our periodic filings.

Latest Financial Results

FY 2025

Fiscal Year Ended Sep 30, 2025

Underlying Orders Growth

Underlying Sales Growth

Adjusted Segment EBITA Margin

Adjusted Earnings Per Share

Source: Q4 2025 Earnings Press Release

Numbers above are Non-GAAP. See reconciliations in our latest press release.

Emerson Is an Innovation Leader Helping Customers Solve Their Most Complex Problems

Emerson has established itself as a trusted partner for industry leaders, with a leading global presence and comprehensive automation portfolio. We deliver every day by executing on our clear value creation framework through organic growth, continued operational excellence and capital allocation. The Emerson Management System supports our performance by keeping our teams laser focused on innovation and driving Emerson forward.

Financial Performance

Sales by Geography

2025

As of Sept. 30, 2025 • 10-K 2025

Net Sales

In Millions

| Year | Revenue | Underlying Sales Growth* |

|---|---|---|

| 2021 | $12,392.00 | -- |

| 2022 | $13,804.00 | $7.00 |

| 2023 | $15,165.00 | $10.00 |

| 2024 | $17,492.00 | $6.00 |

| 2025 | $18,016.00 | $3.00 |

As of Sept. 30, 2025 • 10-K 2025

Adjusted Diluted EPS*

| Year | Adjusted Earnings Per Share* |

|---|---|

| 2021 | $3.01 |

| 2022 | $3.64 |

| 2023 | $4.44 |

| 2024 | $5.49 |

| 2025 | $6.00 |

Note: Data shown is on a continuing operations basis.

*Underlying Sales Growth and Adjusted EPS are Non-GAAP measures. View full reconciliation for 2021, 2022, and 2023 in our

2023 Annual Report. View full reconciliation for 2024 and 2025 in our 2025 10-K.

Latest Annual Filing

For Fiscal Year Ending Sep 30, 2025

Emerson’s Value Creation Framework

Description of Value Creation Framework

Description of Value Creation Framework

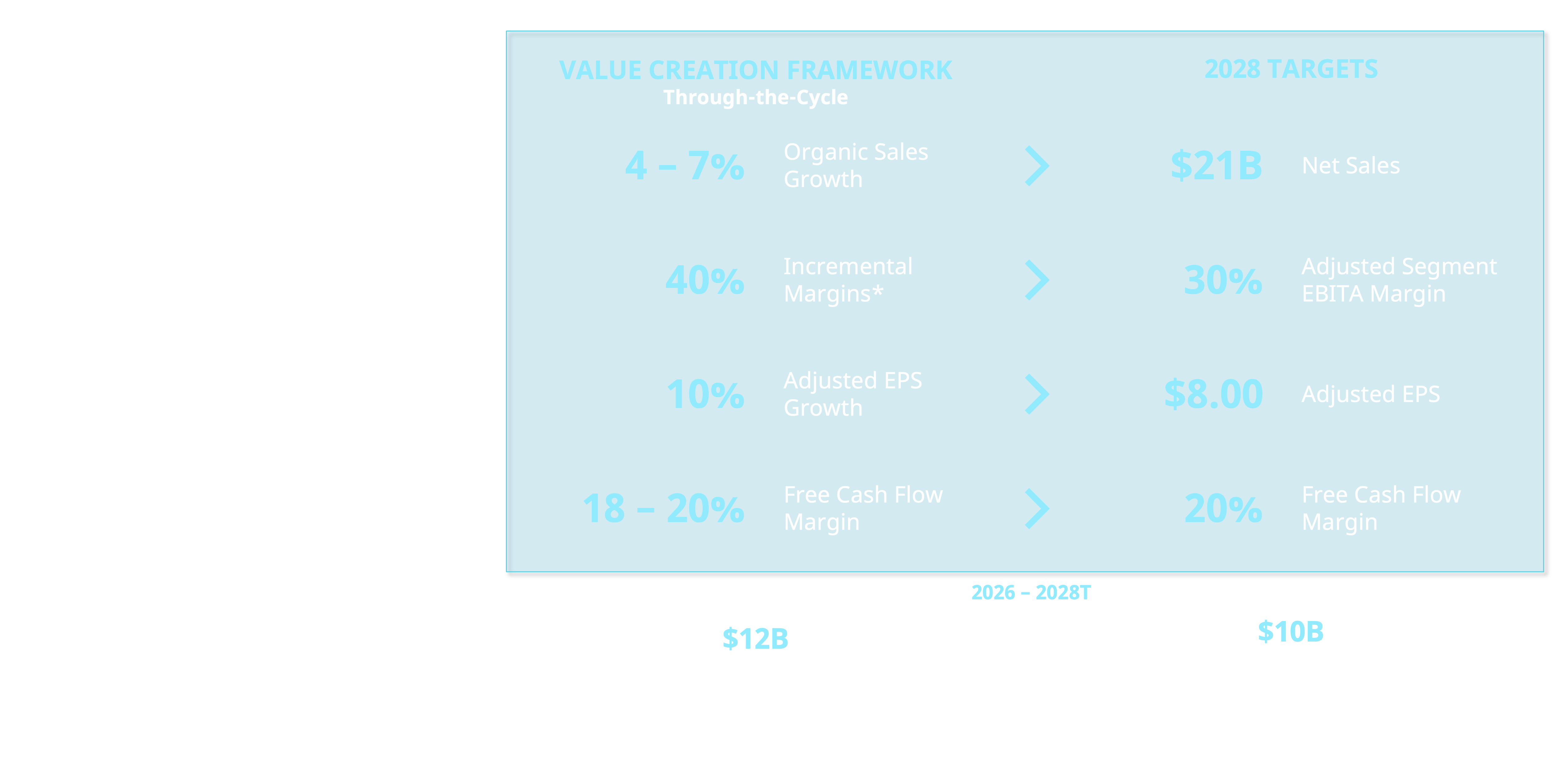

Emerson plans to deliver its value creation framework through organic growth, continued operational excellence and capital allocation. Emerson’s through-the-cycle value creation framework consists of 4-7% organic sales growth, 40% incremental margins, 10% adjusted earnings per share growth and 18-20% free cash flow margin.

Emerson’s 2028 financial targets are $21 billion net sales, 30% adjusted segment EBITA margin (2.4 percentage points of margin expansion), $8.00 adjusted earnings per share and 20% free cash flow margin. Emerson’s financial targets also include generating $12 billion in cumulative free cash flow from 2026 to 2028 and cash returns of $10 billion through $6 billion share repurchase and $4 billion dividends.

IR Contacts

Emerson Global Headquarters

Emerson

8027 Forsyth Boulevard

St. Louis, MO 63105

T: 314-553-2000

Investor Relations

Emerson

Doug Ashby

Director – Investor Relations

T: 314-553-2197

investor.relations@emerson.com

Transfer Agent

Computershare

Attention: Emerson Electric Co.

P.O. Box 43006

Providence, RI 02940-3006

T: 888-213-0970