SC TO-C: Written communication relating to an issuer or third party tender offer

Published on October 6, 2009

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

________________

SCHEDULE TO

Tender

Offer Statement under Section 14(d)(1) or 13(e)(1) of

the

Securities Exchange Act of 1934

AVOCENT

CORPORATION

(Name

of Subject Company)

GLOBE

ACQUISITION CORPORATION

EMERSON

ELECTRIC CO.

(Names

of Filing Persons — Offeror)

Common

Stock, Par Value $0. 001 Per Share

(Title

of Class of Securities)

________________

053893103

(Cusip

Number of Class of Securities)

Frank

Steeves

Senior

Vice President, General Counsel and Secretary

Emerson

Electric Co.

8000

West Florissant Avenue

St.

Louis, Missouri

(314)

553-2000

(Name, Address and Telephone Number

of Person Authorized to Receive Notices

and

Communications on Behalf of Filing Persons)

Copies

to:

Phillip

R. Mills, Esq.

Marc

O. Williams, Esq.

Davis

Polk & Wardwell LLP

450

Lexington Avenue

New

York, New York 10017

Telephone:

(212) 450-4000

|

R

|

Check the box if the filing

relates solely to preliminary communications made before the commencement

of a tender offer.

|

Check the

appropriate boxes below to designate any transactions to which the statement

relates:

|

R

|

third-party tender offer subject

to Rule 14d-1.

|

|

£

|

issuer tender offer subject to

Rule 13e-4.

|

|

£

|

going-private transaction subject

to Rule 13e-3.

|

|

£

|

amendment to Schedule 13D

under Rule 13d-2.

|

Check the following box if the filing

is a final amendment reporting the results of the tender

offer. £

This

Schedule TO filing consists of the following documents relating to the proposed

acquisition of Avocent Corporation (“Avocent”) by Emerson Electric Co.

(“Emerson”) pursuant to the terms of an Agreement and Plan of Merger dated as of

October 5, 2009 by and among Avocent, Emerson and Globe Acquisition Corporation,

a wholly-owned subsidiary of Emerson: (i) a Joint Press Release of Avocent

and Emerson dated October 6, 2009; (ii) the transcript of an investor call held

by Emerson on October 6, 2009 to discuss the acquisition of Avocent by Emerson;

and (iii) a presentation used in such investor call.

|

|

|

Contact:

|

Mark

Polzin

|

Contact:

|

Bob

Jackson

|

|

Fleishman-Hillard (for

Emerson)

|

Avocent

Corporation

|

||

|

Phone:

|

(314)

982-1758

|

Director of

Investor Relations

|

|

|

e-mail:

|

mark.polzin@fleishman.com

|

Phone:

|

(256)

261-6482

|

|

e-mail:

|

Bob.Jackson@avocent.com

|

EMERSON

TO ACQUIRE AVOCENT CORPORATION

Agreement

Broadens Network Power’s Data Center Management Capabilities

ST. LOUIS, MO, and HUNTSVILLE, AL; OCTOBER 6,

2009 – Emerson (NYSE: EMR) and Avocent Corporation (NASDAQ: AVCT) today announced they have reached agreement for Emerson

to acquire Avocent, a transaction that will further Emerson’s ability to deliver

total infrastructure

management

solutions to its

data center customers around the world. The Avocent Board of Directors unanimously endorsed the terms of an all-cash tender offer of $25 per share, or approximately $1.2

billion. The purchase is expected to close around

January 1, 2010, pending

customary regulatory approvals and acceptance of the offer by Avocent stockholders holding a majority of Avocent

shares.

Headquartered in Huntsville, Alabama, Avocent recorded sales in 2008 of

$657 million. With global

manufacturing, research and development and sales operations, nearly 50 percent

of Avocent’s

2008 revenues came from

outside the United

States.

-more-

Avocent – page 2

The agreement extends the

integrated solutions Emerson provides to data center managers and creates

significant opportunities for growth. Avocent blends hardware,

software and embedded technologies in a unified platform that simplifies

monitoring, managing and problem solving in any size data center.

Avocent’s IT

infrastructure management technology is recognized as a leader in managing IT

device operating and performance information. These configuration and

monitoring technologies complement Emerson Network Power’s power systems, energy

management and precision cooling solutions. Emerson’s data

center-related revenues were approximately $2.6 billion in fiscal

2008.

“Combining Avocent’s technologies,

relationships and installed base with Emerson’s power and cooling presence

allows us to offer a more compelling solution to our data center customers’ most

pressing challenge -- energy efficiency,” said David N. Farr, Emerson

chairman, CEO and president. “It furthers our customers’ ability to

better manage reliability, availability and lifecycle costs through a simple yet

comprehensive view of the complete data center physical

infrastructure.”

-more-

Avocent – page 3

Mike Borman, Avocent’s CEO, added: “Augmenting Avocent’s ability to access and control the

physical aspects of network devices and servers with information and knowledge

of the broader power and cooling infrastructure forms a powerful combination

missing today from the toolset available to data center

managers.”

Emerson will host a brief presentation

to discuss this transaction today at 10 a.m. Central/11 a.m. Eastern. A

webcast of the presentation will be available in the Investor Relations area of

Emerson’s Web site at www.Emerson.com/financial at the time of the event, and an

archive replay will be available for approximately one week.

About AVOCENT Corp.

Avocent delivers IT

operations management solutions that reduce operating costs, simplify management

and increase the availability of critical IT environments 24/7 via integrated,

centralized software. Additional information is available at www.avocent.com.

About

Emerson Network Power

Emerson Network

Power, a business of Emerson (NYSE:EMR), is the global leader in enabling

Business- Critical Continuity™ from grid to chip for telecommunication networks,

datacenters, health care and industrial facilities. Emerson Network Power

provides innovative solutions and expertise in areas including AC and DC power

and precision cooling systems, embedded computing and power, integrated racks

and enclosures, power switching and controls, monitoring, and connectivity. All

solutions are supported globally by local Emerson Network Power service

technicians. Liebert power, precision cooling and monitoring products and

services from Emerson Network Power improve the utilization and management of

datacenter and network technologies by increasing IT system availability,

flexibility and efficiency. For more information, visit: www.EmersonNetworkPower.com.

About

Emerson

Emerson (NYSE: EMR), based in St.

Louis, Missouri (USA), is a global leader in bringing technology and engineering

together to provide innovative solutions to customers through its network power,

process management, industrial automation, climate technologies, and appliance

and tools businesses. Sales in fiscal 2008 were $24.8 billion, and Emerson is

ranked 94th on the Fortune 500 list of America’s largest companies.

For more information, visit www.Emerson.com.

-more-

Avocent – page 4

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

THIS PRESS RELEASE

CONTAINS CERTAIN FORWARD-LOOKING STATEMENTS. THESE FORWARD-LOOKING STATEMENTS

MAY BE IDENTIFIED BY WORDS SUCH AS “BELIEVES”, “EXPECTS”, “ANTICIPATES”,

“PROJECTS”, “INTENDS”, “SHOULD”, “SEEKS”, “ESTIMATES”, “FUTURE” OR SIMILAR

EXPRESSIONS OR BY DISCUSSION OF, AMONG OTHER THINGS, STRATEGY, GOALS, PLANS OR

INTENTIONS. VARIOUS FACTORS MAY CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY IN THE

FUTURE FROM THOSE REFLECTED IN FORWARD-LOOKING STATEMENTS CONTAINED IN THIS

PRESS RELEASE, AMONG OTHERS: (1) ECONOMIC AND CURRENCY CONDITIONS;

(2) MARKET DEMAND; (3) PRICING; (4) COMPETITIVE AND TECHNOLOGICAL

FACTORS; (5) THE RISK THAT THE TRANSACTION MAY NOT BE CONSUMMATED; (6) THE

RISK THAT A REGULATORY APPROVAL THAT MAY BE REQUIRED FOR THE TRANSACTION IS NOT

OBTAINED OR IS OBTAINED SUBJECT TO CONDITIONS THAT ARE NOT ANTICIPATED; (7) THE

RISK THAT AVOCENT WILL NOT BE INTEGRATED SUCCESSFULLY INTO EMERSON; AND (8) THE

RISK THAT REVENUE OPPORTUNITIES, COST SAVINGS AND OTHER ANTICIPATED SYNERGIES

FROM THE TRANSACTION MAY NOT BE FULLY REALIZED OR MAY TAKE LONGER TO REALIZE

THAN EXPECTED.

ADDITIONAL

INFORMATION AND WHERE TO FIND IT

THIS PRESS RELEASE

IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE AN OFFER TO PURCHASE

OR A SOLICITATION OF AN OFFER TO SELL AVOCENT COMMON STOCK. THE SOLICITATION AND

OFFER TO BUY AVOCENT COMMON STOCK WILL ONLY BE MADE PURSUANT TO A TENDER OFFER

STATEMENT ON SCHEDULE TO (INCLUDING THE OFFER TO PURCHASE AND RELATED MATERIALS)

THAT GLOBE ACQUISITION CORPORATION, A WHOLLY-OWNED SUBSIDIARY OF EMERSON,

INTENDS TO FILE WITH THE SECURITIES AND EXCHANGE COMMISSION (SEC). IN ADDITION,

AVOCENT WILL FILE WITH THE SEC A SOLICITATION/RECOMMENDATION STATEMENT ON

SCHEDULE 14D-9 WITH RESPECT TO THE TENDER OFFER. AVOCENT’S INVESTORS AND

SECURITY HOLDERS ARE URGED TO READ THESE MATERIALS, ANY AMENDMENTS TO THESE

MATERIALS, AND ANY OTHER DOCUMENTS RELATING TO THE TENDER OFFER THAT ARE FILED

WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE PRIOR TO

MAKING ANY DECISIONS WITH RESPECT TO THE OFFER SINCE THEY WILL CONTAIN IMPORTANT

INFORMATION, INCLUDING THE TERMS AND CONDITIONS OF THE OFFER. INVESTORS AND

SECURITY HOLDERS MAY OBTAIN A FREE COPY OF THESE MATERIALS (WHEN AVAILABLE) AND

OTHER DOCUMENTS FILED BY EMERSON AND AVOCENT WITH THE SEC AT THE WEBSITE

MAINTAINED BY THE SEC AT WWW.SEC.GOV. THE OFFER TO PURCHASE AND RELATED

MATERIALS MAY ALSO BE OBTAINED (WHEN AVAILABLE) FOR FREE BY CONTACTING EMERSON

AT 8000 WEST FLORISSANT AVENUE, ST. LOUIS, MISSOURI 63136, (314)

553-2197. THE SCHEDULE 14D-9 MAY ALSO BE OBTAINED (WHEN AVAILABLE)

FOR FREE BY CONTACTING AVOCENT AT 4991 CORPORATE DR., HUNTSVILLE, ALABAMA 35805,

(256) 261-6482.

###

|

Final

Transcript

|

|

|

Conference Call

Transcript

EMR - Emerson Electric to Acquire

Avocent Corporation

Event Date/Time: Oct. 06. 2009 /

11:00AM ET

|

|

THOMSON

REUTERS STREETEVENTS | www.streetevents.com | Contact

Us

©

2009 Thomson Reuters. All rights reserved. Republication or redistribution

of Thomson Reuters content, including by framing or similar means, is

prohibited without the prior written consent of Thomson Reuters. 'Thomson

Reuters' and the Thomson Reuters logo are registered trademarks of Thomson

Reuters and its affiliated companies.

|

|

1

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

CORPORATE

PARTICIPANTS

Lynne

Maxeiner

Emerson

Electric Co. - Director IR

David

Farr

Emerson

Electric Co. - Chairman, CEO, President

Walter

Galvin

Emerson

Electric Co. - SEVP, CFO

CONFERENCE

CALL PARTICIPANTS

Bob

Cornell

Barclays

Capital - Analyst

Steve

Tusa

JPMorgan

- - Analyst

Deane

Dray

FBR

- - Analyst

Christopher

Glynn

Oppenheimer

& Co. - Analyst

Michael

Schneider

Robert

W. Baird & Company, Inc. - Analyst

Judy

Delgado

Analyst

Martin

Sankey

Neuberger

Berman, LLC - Analyst

PRESENTATION

Operator

Ladies

and gentlemen, thank you for standing by. Welcome to the Emerson agreement to

acquire Avocent Corporation conference call. (Operator Instructions). This

conference is being recorded today, Tuesday, October 6, 2009.

Emerson's

commentary and responses to your questions may contain forward-looking

statements, including the Company's outlook for the remainder of the year.

Information on factors that could cause actual results to vary materially from

those discussed today is available in Emerson's most recent annual report on

Form 10-K as filed with the SEC.

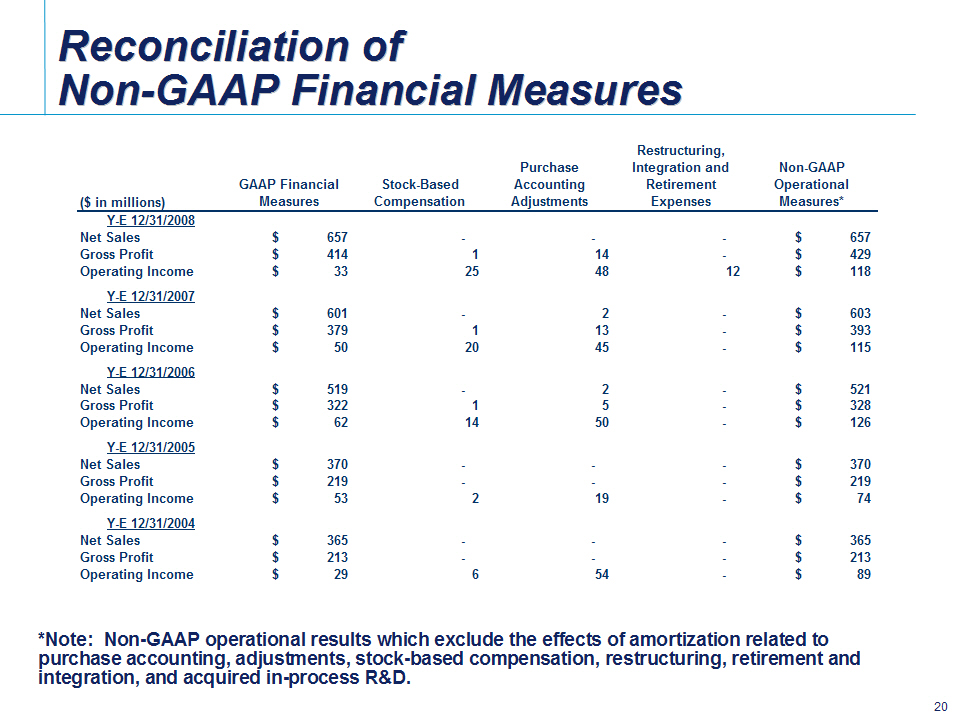

In this

call, Emerson's management will discuss some non-GAAP measures in talking about

the Company's performance, and the reconciliation of those measures to the most

comparable GAAP measures is contained within a presentation that is posted in

the investor relations area of Emerson's website at

www.Emerson.com.

I would

now like to turn the conference over to our host, Ms. Lynne Maxeiner, Director

of Investor Relations. Please go ahead, ma'am.

Lynne

Maxeiner - Emerson Electric

Co. - Director IR

Thank

you, Douglas. I am joined today by David Farr, Chairman, Chief Executive

Officer, and President of Emerson; Walter Galvin, Senior Executive Vice

President and Chief Financial Officer; Craig Ashmore, Senior Vice President,

Planning and Development; and Ed Feeney, Executive Vice President and business

leader for Emerson Network Power.

2

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

Today's

call will cover Emerson's announcement of its agreement to acquire Avocent. A

conference call slide presentation is available in the investor relations

section of Emerson's corporate website. A replay of this conference call and

slide presentation will be available on the website after the call for

approximately one week. I will now turn it over to Mr. David Farr.

David Farr - Emerson Electric Co. - Chairman, CEO, President

Thank you

very Lynne -- thank you, Lynne. Thanks, everybody, for joining us this

morning.

This is a

little bit different for me. What we have here is a presentation out there. I

want to flip through it.

The key

thing you need to know is that this is what I call a strategic marquee

acquisition for us within the network power space. It's one that we have been

working on for quite some time. It's a technology, you'll see, that is going to

allow us to create a lot stronger solutions presence and a stronger presence in

the data center infrastructure marketplace -- clearly strengthen us on a global

basis.

So what I

would like to do is go through the presentation. And the numbers on the

presentation, if you have a copy, are on the bottom right-hand side, and I'm

going to go to the second chart and -- which highlights the Emerson Network

Power profile.

In 2008,

the whole business of Emerson Network Power was $6.3 billion. The Emerson data

center sales by market in the business is $2.6 billion, and this is where

Avocent comes into play from a standpoint of the strategic fit. And I will talk

more about this but basically this is adding a very strategic component to where

we want to go and create more value, more solution capability for the data

center infrastructure and what we have to offer going forward here.

So let's

go to page three. Within the data center today, Emerson has a very strong

presence. We have, as I said, $2.6 billion and we cover the data center room, as

we've talked about in our analyst presentations.

We have

basically equipment throughout the whole data center from precision cooling to

dense cooling. We have surge suppression, uninterruptible power supplies. We

have power distribution units. We support the generators, the CAT generators or

other generators out there. We have the automatic switch and we actually have

enterprising monitoring system capabilities today.

Then,

within a rack, if you think about a rack within a data center, which is the box

and it looks usually black, we have cable managing, rack cooling. We have -- the

power supply is coming out of Astec. We actually make the rack, and we have

managed power strips and we have UPS and we have environmental sensors. So we

actually today are a major player in the data center today, relative to

equipment, both inside the rack and outside the rack.

And the

key areas that you're going to see going forward is how do you coordinate that

and how do you play all those together going into the future. That's what

Avocent is all about for us. It's a key, integral part of tying that technology

altogether.

As we go

forward to page four, as we look at the data center and the issues and the

emerging strategies today, you quickly see in the lower left-hand corner,

Emerson is involved in energy consumption of close to 60% of the data center,

from precision cooling to embedded power supplies and UPS. Clearly, when you

think about energy efficiency and you think about the needs of the data center

today, it's about energy, it's about availability, it's technology, and the

whole dynamic infrastructure management.

And this

is where Emerson is trying to focus, how we can create a value solution for our

customers using our technology-leading products today, be it a UPS, be it a

precision cooling unit or a power supply, and now, with Avocent, the KVM

solution capabilities there and software capabilities.

The data

center driven, and today as we look at it is off a global server marketplace,

and it's a growing marketplace and will continue to grow as we look at it. The

growth rate has been impacted by the virtual server activity going out there.

That will continue, but that will eventually run its course. And you will see a

pretty strong underlying growth for us.

The key

area for us basically is on the right-hand side. We want to continue to shift

the efficient hardware, both in servers and storage in the network area.

Powering cooling infrastructure. We want to be involved in the design data

center for efficiency. You know, managing those -- the room, configuring the

racks, trying to have people understand what's going on inside that data center.

What servers to come in and out.

3

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

We want

to be able to manage power. We want to be able to manage air-conditioning. We

want the data centers to be able to control the infrastructure they have, which

we are a major supplier within that area. Where does the cooling need to go?

Where do we need to back it down? Where do they need UPSes? And so on and so

forth.

We want

to shift loads real time, use the most efficient hardware, use the most

efficient capabilities within that data center, and we want to be able to turn

off things and turn things back on. From the standpoint if you have excess power

going through it, or you have a unit that may be going bad, we want to be able

to manage this and this is what the Avocent strategy is all about, tying in very

closely to what we have to offer today.

And this

is going to allow us to get into a much larger market. As I see it, it's going

to allow us to expand our served market by at least $2 billion to $3 billion.

Avocent alone is a $1.0 billion-plus type of marketplace we're going into, and

then if you look at the solutions capabilities as we go down the market road in

the next five to 10 years, it's going to allow us to expand our solutions

capability into another -- add another $2 billion or $3 billion of capable sales

that we can go after in the marketplace, which is all very important to us

relative to our underlying growth rate and the future of Emerson.

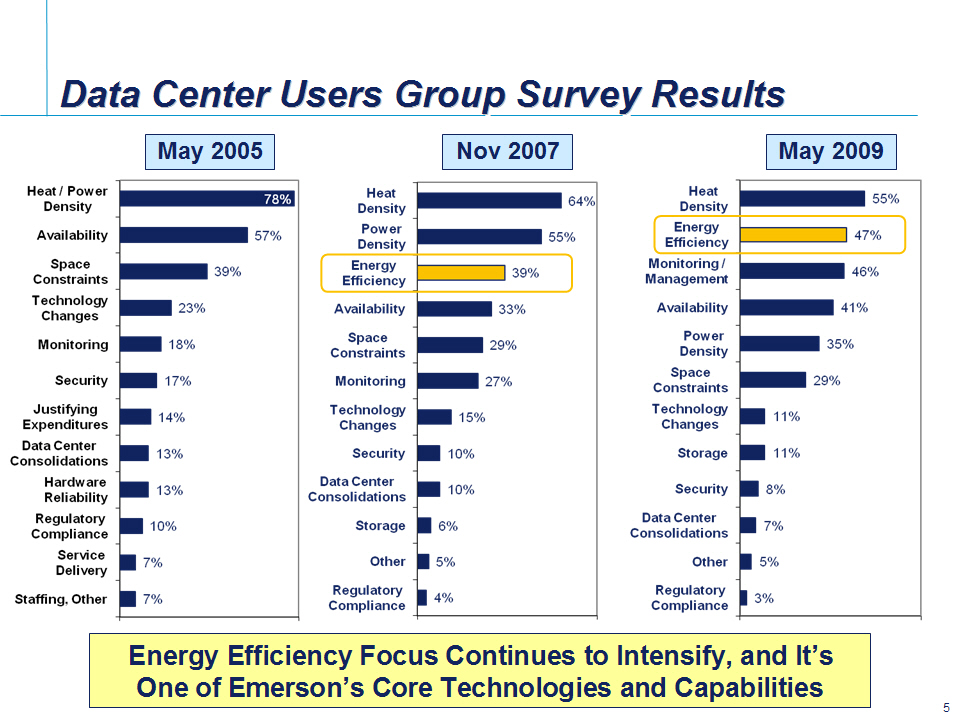

You go

forward to page five. Obviously, we are in the data center today. We do surveys

constantly with our customers, and if you look at the progression over the last

couple of years, energy efficiency and heat density, these things -- and

monitoring and management, availability, all have become very, very major

players relative to what the customer needs.

And so,

energy efficiency has moved right up there to number two, right behind heat

density, and then you've got monitoring and management and you've got

availability. These are things that we are able to do, and now with the addition

of Avocent, we can do a lot more and we can bring a much stronger solution to

our customer over the next couple of years.

And this

is a key part, as you will quickly see. Their products are an integral part of

communication within a data center, which allows us to tie all our capabilities

together and then communicate up into the main systems and allow the data center

to do a lot more with the key data that we will supply to them.

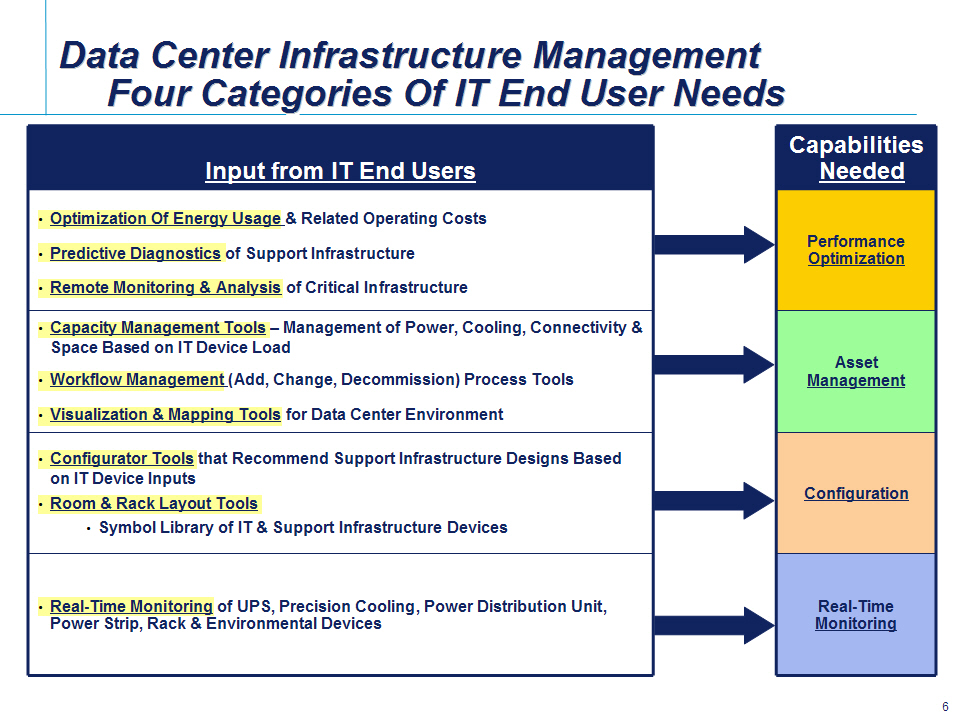

Going

forward to page six, there are four areas. You've seen this chart before. We've

used this in talking about our Liebert and our whole network power

infrastructure strategy over the last couple of years.

There are

four key areas, capabilities, the needs from the customers -- performance

optimization, asset management, configuration, and real-time

monitoring.

And what

we've been about is trying to develop a capability, both from a product

standpoint, a solution standpoint, a software standpoint, and a service

standpoint, to serve these four key areas. And you will quickly see where our

products come into play today, and we are stronger clearly in some areas than

others, and we are -- with the addition of Avocent, it will allow us to

strengthen our capabilities across these four areas and allow us to create more

value for our customer and allow them to have more control and more management

of that infrastructure within the IT world, which is very important as we go

forward here in the next five to 10 years.

But

clearly, this has taken the game up a big notch as we look at our network power

infrastructure business today. Like we did in process as we developed the

capabilities with a next generation of systems and solutions in software, we

have changed the game from being just the best-in-class device company, be it a

UPS or precision cooling, to now offering a much more comprehensive service and

solution and software capability, and this whole infrastructure management in an

IT world. So that's what we're all about.

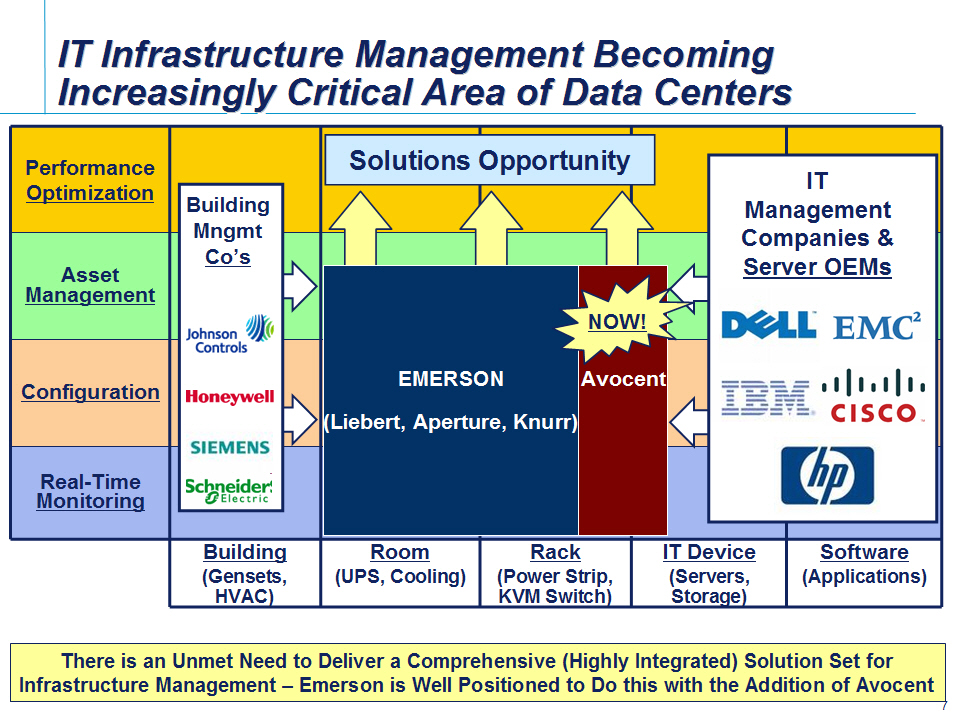

If you go

to the next page, page seven, you've seen this chart. I've showed this chart, I

think, the last two or three strategy sessions with our key investors in New

York or here in St. Louis. And what you see here now with the addition of

Avocent, it fits right next, adjacently, to where Emerson is with Liebert and

Aperture and Knurr.

It allows

us to have a lot more capability in that room and the racks and the IT devices,

and allows us to expand our solutions capability up into those four categories

we talked about -- real-time monitoring, configuration, asset management, or

performance optimization.

Fundamentally,

this allows us to develop what I consider a highly integrated solution for the

data center. It allows us to take our precision cooling, bring in the software

capability, which we will have to develop to tie all our capabilities together,

and then communicate, as I saw you later, up into the IT organization and give

those IT managers a lot more capability to manage the data center more

efficiently, more cost effectively, and to really know what's going on inside

that data center real-time.

4

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

That's

what it's all about. Real time. Just like a process plan as I look at

it.

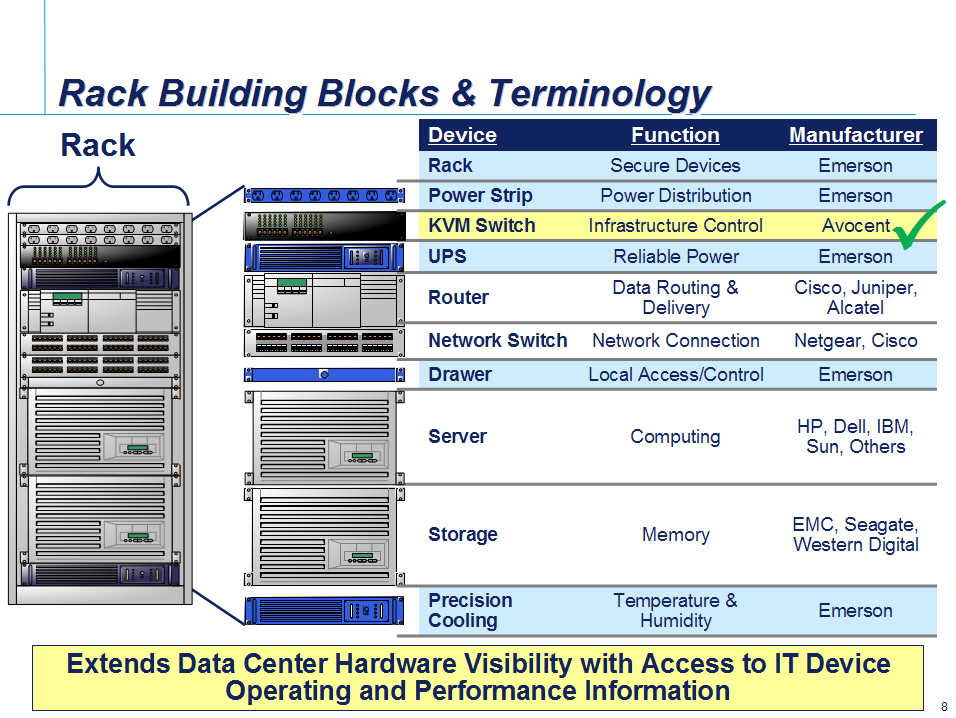

If you go

forward to page eight, you will see in a rack where Emerson is today. We have

precision cooling. We have what we call the drawer, the local access and

control. We have UPS. We have power strips. We make the rack.

And now

with the addition of Avocent, we have the leader in KVM switches, which is going

to be the key infrastructure control aspect to what we're trying to do here. It

is the control capability within that rack to what's going on inside that rack

with a technology we are going to develop here, and the software capabilities

we're going to develop here, to allow us to communicate amongst that rack and

then also outside that rack to other racks in the whole data center, and really

collect that information and take that information up into the IT network so

they can know what's going on inside that rack, across the racks, and really

create a viable information system capability for the operators inside that data

center.

If you go

forward to page nine, you will see today typically the KVM switch application --

it can control one to 64 servers. It communicates, it goes into the IT

administration, it goes across different sites, so not just one site. It can

communicate across different sites.

And

basically, it gives the IT administrator the -- remote visibility, access and

control of connected IT devices. Now what we want to do, given the fact that we

have a lot of other devices in this data center, just like a process plant, we

want to connect our UPS, we want to connect our precision cooling, we want to

connect to that backup power, we want to connect the power strips. We want to be

able to communicate across this whole data center and allow a more solution

capability for the operators of that data center.

Just like

we have here in St. Louis with our new data center, we want to be able to

control that data center, have that information, and know what's going on inside

that data center at any point in time, and make decisions real-time, which is

not something that really can do today across all the spectrum of products that

we have out there in that IT data center today.

If you go

to page 10, you see the profile of Avocent. It's a great company, located down

in Huntsville, Alabama. It's a very global company, you can see, with basically

a 50-50 split between international and the United States, and it's a company

historically that has grown.

Obviously

with 2009, it's had a very difficult year just like everybody else in the

marketplace from Emerson to anybody. I don't care where you are. A Cisco,

anybody. Everyone in this market space has had a very challenging

year.

It's a

profitable company. They have great gross profit and they have technology. The

key thing for us is they have technology within that data center that we'll be

able to utilize to create a bigger solution and to integrate with our

capabilities today we have in Liebert and our whole network power data center

infrastructure.

So from

our standpoint, this is a key aspect or a key milestone into creating a much

stronger package for our data center infrastructure. It's something that we've

been missing, and they really bring a capability to the marketplace and to

Emerson that will strengthen us as we go forward.

And as

you know, this is a long term, a very good growing, a very good, profitable

business for Emerson.

Going

forward, let's go to page 11. As I said, they are a profitable market leader in

a well-structured industry.

If you go

to page 12, you'll quickly see, on a global basis, their market today on a KVM

is $1.2 billion. They are a very strong presence around the world, both in the

Americas and in Europe and in Asia, just like our network power business today.

Our network power business today has 60% of their sales outside of the United

States, so I believe that we'll be able to strengthen the KVM and the Avocent

business both in Europe and in Asia because of the strong presence that we have

in those markets today.

We are

strong in Asia, in particular, with the whole network power aspects that we

have, and we're a very global player. I believe -- I can't remember, Lynne,

today, but we're probably close to 60%, 62% outside the United States today with

our network power infrastructure, which is very, very important to

us.

If you go

forward and look at page 13, as I've talked about, it significantly enhances our

Emerson's data center solutions. It brings a very comprehensive software

package.

5

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

It's

going to allow much greater visibility inside the entire data center

infrastructure to better control the energy consumption, to manage the cost and

complexity of the operations. It's going to allow us to basically combine the

data center infrastructure and IT device knowledge, and allow us to do a lot

more unique solutions capability.

We are

going to have to jointly develop some software capability and embed it both

inside our products and also the Avocent products that allow us to do more

within that data center. We have unique solutions today, but really in the next

couple of years we're going to have to develop even more solution capability to

offer a stronger solutions aspect for the IT manager.

And the

discussion between the two companies has already started, and we're going to

have to launch that very quickly post the closing to develop, I think, a very

unique product offering in the software and the software management capability

and the solution capability, tying our two businesses together in a very uniform

capability which will strengthen the offering to the marketplace.

If you go

forward, basically what we're talking about here on page 14, if you look on the

infrastructure management you see Emerson down there. I mean, the transfer

switches, the UPS, the precision cooling, all the capabilities we have today in

the infrastructure management. If you go up one more notch, you'll look at the

KVM and network connection, and you'll see where the KVM sitting on top of that

rack, or on top of that server, is going to allow us to use that capability and

that connectivity into the network to bring the infrastructure management

knowledge that we have.

As I look

at that plant floor of the data center, what we're going to do is we're going to

connect and collect and monitor and send that information up into the operating

information for the ITSM or optimization at the very top, and allow that data

center organization, the IT service management group, the ITSM, to manage the

data that we're going to supply them.

We're

going to pass this information up. We are not going to be at the top. We're

going to pass this information up and allow this information to be used to

manage that data center much more efficiently from an energy standpoint. Which

racks are going to be coming on? Which racks are going to be going off? Where do

you have problems with your servers? Where do you have problems with your UPSes?

And that's what this is all about.

It's

going to be the room and rack management capabilities, and we are going to

create that unique capability at the marketplace to give them that performance

optimization, asset management, the configuration, and the real-time monitoring.

That's what this game is about, creating the best-in-class capabilities, the

products we have out there, both with Emerson and then with Avocent, tying

together with a whole infrastructure management capability and a solutions and a

software which really creates value for our customer, and it solidifies our

presence in this very, very important global marketplace which we serve, as I

said, over $2.5 billion today.

If you go

forward and you look at the four capabilities and what Avocent does with

Emerson, you see the combination of Emerson and Avocent really gives us a lot

stronger capabilities in the performance optimization, asset management, and the

configuration, and real-time monitoring. Some cases, we -- unique combination

right now, we'll have a very strong presence. That's what the solid green dots

are.

The

yellow ones, we are going to have to work and we're going to have to create a

lot more capability, both from a software standpoint and the solutions

capability standpoint. But these things can be done over the next couple of

years, and you'll see a very strong Emerson/Avocent presence in these four key

areas.

This is

where the data centers want to go. This is what they need. They need to optimize

and they need that asset management, and they need to make sure they are using

their energy efficiency the best they can in today's world as you go forward.

Energy efficiency is on everyone's mind, as we see, relative to what's going

on.

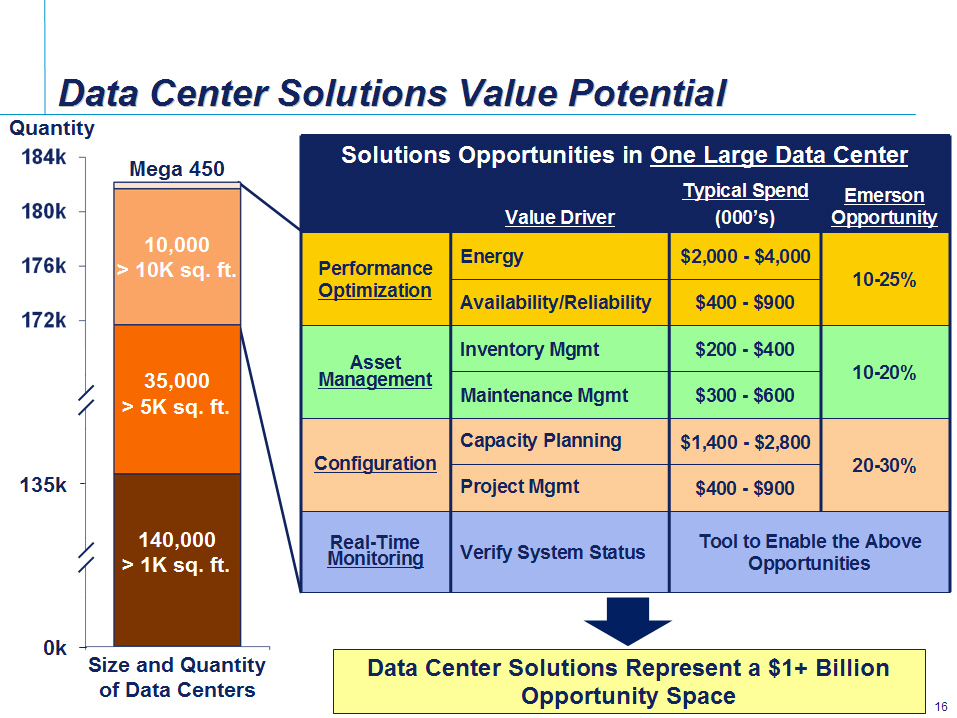

If you go

forward to page 16, one of the key things that we've looked at and you look at

trying to quantify, as I said earlier, I believe that you have the addition of

the current KVM marketplace, which is over $1 billion globally. If you look at

what goes on inside the data center today and the opportunity that we can bring

from the spend and how we can save them money, we believe that we can create a

$1 billion-plus additional served market in the next couple of

years.

I

personally think it's greater than $1 billion. I think it would be -- it could

go $1 billion to $2 billion.

So what

we're going to do is we're going to expand the capabilities that we have today

in those data centers, and there is a lot of data centers out there. You're

looking at, on the left-hand side, 10,000 -- greater than 10,000 square feet --

35,000 greater than 5,000. And 140,000 worldwide greater than

1,000.

6

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

This is

what we're going to take our solution. This is the market we're going to serve.

It's a lot of capability -- over 180,000 data centers out there. With our unique

solution and product capability, it will allow us to expand the market. That's

what this is all about.

We serve

this market today, but what we want to do is expand it and take more of a

solution capability in, and allow us to grow that $1 billion to $2 billion to $3

billion served market space for us, allow us to penetrate with what I consider a

very profitable business aspect that we offer today at network power and also

with the Avocent addition.

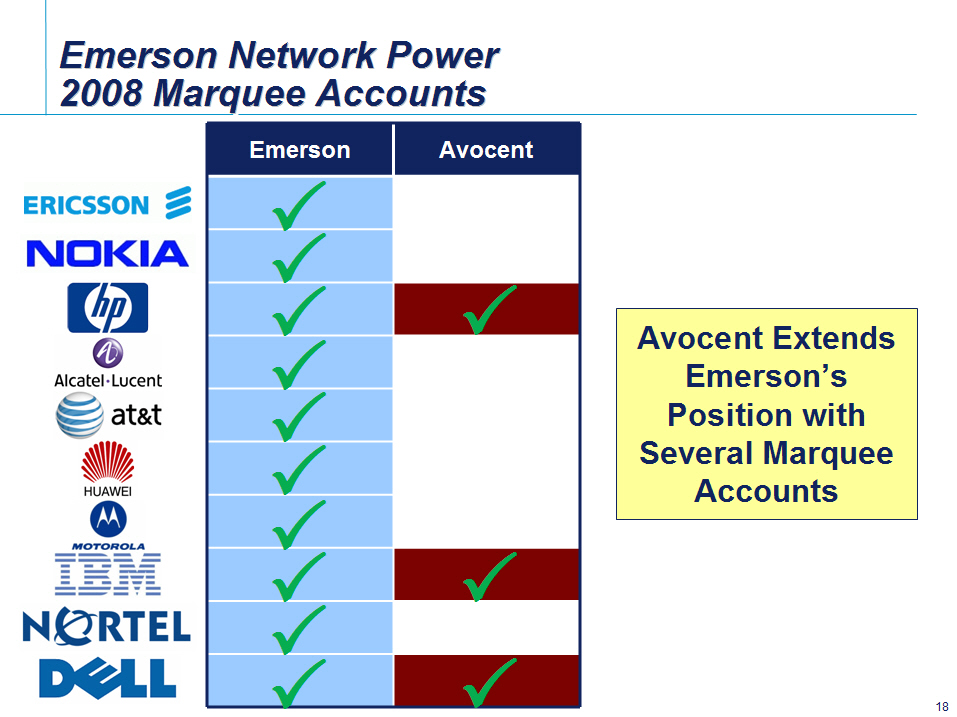

If you

look at the Avocent -- the customer presence and their channel presence, it's

going to add to what we have today. If you go forward two charts to chart 18, we

are very strong in many of these global customers, these marquee customers, be

it HP, be it Ericsson, or IBM or Nortel or Dell.

But with

the addition of Avocent, they are very, very strong in HP, IBM, and Dell. So

it's going to solidify our marquee account aspect on a global basis, which is

very important when it comes to having that credibility on a global reach to

serve these very large global marquee customers. And with the addition of

Avocent, and the combination of Avocent and Emerson, it'll really strengthen our

presence in these key marquees, and this allows us to do more for these

customers and give our customers a lot more confidence that we have the

solutions and capability to support them as they move forward and go on a global

basis.

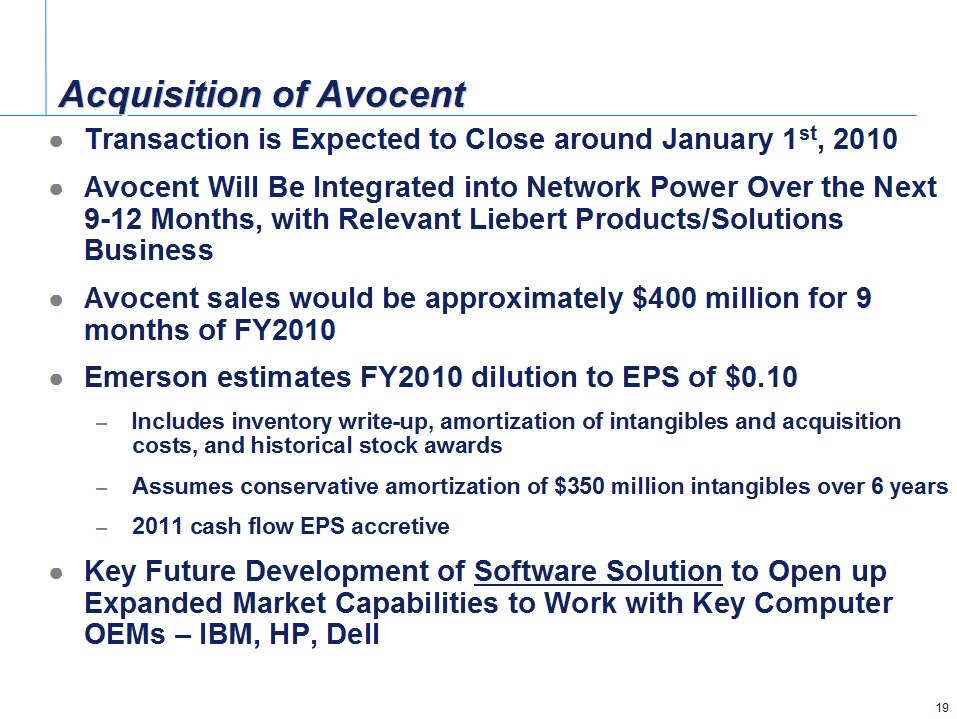

Going

forward to page 19, let's talk about the acquisition. This is, what I'd say, a

marquee acquisition for us, as I refer to it. This is a very strategic

acquisition for us. This is different than a typical, what I would say, just a

pure bolt-on acquisition. It's going to give us -- allow us to expand our market

and allow us to do a lot more for our customers.

We expect

this transaction to close sometime around January 1. You have the normal,

obviously, regulatory approvals around the world. How long it takes, we're not

quite sure. But it's going to be sometime in the middle of December, towards the

end of December, early January.

And

clearly, if you look at it, I would rather not have a stub couple of weeks in

here, but I would -- from my perspective, January 1 would be a very nice

closing. But we will close when it's appropriate relative to approval from the

governments around the world.

We will

integrate network -- Avocent within the network power business reporting into Ed

Feeney. He is on the phone right now. And create over the next nine to 12 months

a relevant Liebert and product solutions capability within Avocent. There's a

lot of work to do here.

But this

is clearly about creating more technology. It's about creating more of a

solution capability. This is not necessarily about what I would call a cost of

integration or a synergy case standpoint. This is about growth and improving our

global capabilities from a standpoint of a technology and product and solutions

for our customer, allowing us to grow more on a global basis.

Both

businesses are already very profitable today. I think we can do more, clearly.

But this is not about synergies from a cost standpoint. It's about synergies

from a growth standpoint.

If you

look at the nine months, assuming that -- our fiscal year, we are now into a new

fiscal year, 2010. We're glad to get 2009 behind us as we move into 2010, as I

told the Board last night.

We will

probably have nine months of Avocent, around $400 million of sales. That's an

approximate number. We are being conservative. It's hard to say right now

exactly once they've closed and what's going to happen, but we're being

conservative. It's around $400 million of sales for Emerson.

If you

look at the impact for us next year, it will be significant. We have the issue.

It's going to be $0.10 -- is our current conservative estimate of this. It's

included in the inventory write-offs, amortization of intangibles, acquisition

costs which you have to write off, and historical stock awards we'll have to

expense.

The key

issue for us is that we made the decision that right now we're going to write

off the amortization of the intangibles over six years. That's a very fast time

period. This is a technology acquisition. I feel much more comfortable getting

that behind us over the next five to six years to make sure that we deal with

this from the standpoint of not having problems down the road.

It's

around $350 million as we look at it right now. Running that off over six years

is a very large, non-cash P&L hit to us. But I feel very conservatively that

we should do that on a quicker basis, not spreading that over 10 or 12 years,

which would be something you could do, but I

7

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

think

that would be wrong to do relative to what we want to do with this technology

and this innovation that we are going to go forward here. You want to do it

quicker, not longer, in my case.

It will

be cash flow accretive from an EPS standpoint in 2011. Again, as we get our

hands around the acquisition and as we get into -- have the chance to

incorporate it, we'll give you tighter numbers as we get into that into our

second fiscal quarter, but right now, this is what we -- Walter, Craig, and Ed

and I have been looking at this for the last couple of weeks from a conservative

standpoint.

We think

this is the way to look at it right now. It will hit us $0.10 next year, but

it's going to really help us from a growth standpoint, a technology standpoint

on a global basis, and clearly we'll get better as we go forward here in the

coming years.

Number

one issue, as I talked about, is the future development of the software solution

to open up an expanded market capabilities for key computer OEMs. Clearly,

trying to be able to take our best-in-class assets and infrastructure assets

inside the data center, the Avocent best-in-class assets in that data center,

and have them all tied together and all communicate together is very, very

important.

This

opens up a great solution capability both for our customers and our customers'

customers. It allows us to do a lot more for them today and really gives us a

lot more of a growth platform as we go forward, as we see the marketplace

changing as they focus on optimization, as they focus on energy, as they focus

on getting the most out of their assets, which many of those assets are our

assets in that data center.

So, as I

wrap this up, this is a very strategic acquisition for us. It's one that I've

been talking about, not by name, but as you've heard me talk about over the

years, talking about that what I call strategic marquee adjacent space type

acquisition, allowing to solidify and strengthen one of our core businesses, the

network power business. In particular, the network power infrastructure for the

data center, which is over $2.5 billion today and doing extremely well around

the world.

So, I'm

welcoming Avocent. It's a great organization. A lot of good people. A lot of

great technology. And I think we can strengthen them on a global basis when I

look at where we are located today and how strong we are internationally, and I

look at what they offer us and what we can do together, so I'm very excited

about the capabilities that Avocent is bringing to this party and I'm very

excited about the whole solutions aspect of bringing what we have of Liebert and

our network power infrastructure today and bringing Avocent to

that.

So with

that, I would like to open the floor. Clearly, given it's a public company and

we have obviously regulatory issues going forward in this, I'm not going to get

into a lot of specifics here, more than I'm talking about here, from a numbers

standpoint.

But I

thought it was very important for our shareholders and our analysts to have an

understanding what's behind this move this morning. Why we made a $1.2 billion

acquisition in this space, why now, and why this company.

I think

you could see with this information we put out there, it's very strategic, it

fits as well, and I think we can make a very strong case going forward that it

will create value for our shareholders over the long term. With that, I'll open

the floor up for questions.

QUESTION

AND ANSWER

Operator

(Operator

Instructions). Bob Cornell, Barclays Capital.

Bob

Cornell - Barclays Capital -

Analyst

You know,

yes, when Emerson is marquee, we pay attention. The -- but you talked about some

of the things that need to be developed, right? It sounds like Avocent has been

headed in a certain direction, and in order to accommodate the solutions

capability you're talking about, you need to change directions a little bit,

coordinate, and head in the -- . Maybe if you could just flesh out what you

really meant there in terms of developing the capability to do the solutions

you're talking about.

David Farr - Emerson Electric Co. - Chairman, CEO, President

8

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

I think

the key issue is Avocent was moving down the line of creating that communication

capability. They have products coming out right now.

But what

I want to be able to do is tie the whole infrastructure together. And so, given

the fact that we have a strong presence in that data center today, what I want

to be able to do is broaden their communication capability across a UPS or

precision cooling or the switches, and allow them to do a lot more within the

data center today, which they were not going to totally get access to. They

could get part of it; it was not very efficient.

You think

about it, Bob, you know the process control plant. Now, with a -- just think

about a Delta V or an Ovation having total -- totally integrated solution

capability within transmitter or control valve. That's what we're talking about

here. Creating a very integrated capability to communicate amongst all of these

products.

So we're

going to have to expand the development effort within Avocent, and also we have

with our own company called Aperture, we were doing the same thing. So now we

have the two together and we can really expand that offering. That's what that's

all about.

And it

will take us a couple of years to do that. We have the capability today, but we

want to take it to the next level just like the new Delta V that we brought out,

announced last week.

Bob Cornell - Barclays Capital - Analyst

The --

you gave us the dilution math and talked about accelerated amortization of

intangibles. What sort of financing costs are you assuming as part of that

dilution math? In other words, are we assuming just use the cash or are you

going to -- are you assuming some sort of cost of debt in that

math?

Walter Galvin - Emerson Electric Co. - - SEVP, CFO

Yes, we

are using a blended capital structure, so you can say it probably will round to

somewhere between 4.5% and 5%, some commercial paper, some long-term debt,

because clearly the nature of this is you'd have a chunk of long-term debt as

well. We tend to be conservative, as you know, Bob.

Bob Cornell - Barclays Capital - Analyst

Yes, I

do.

David Farr - Emerson Electric Co. - Chairman, CEO, President

We're not

- -- don't assume a commercial rate in this debt.

Walter Galvin - Emerson Electric Co. - - SEVP, CFO

Yes.

David Farr - Emerson Electric Co. - Chairman, CEO, President

That's

not something -- I think that's totally inappropriate on a long-term

investment.

Bob Cornell - Barclays Capital - Analyst

Okay, I

will pass the baton. Thanks, you guys. (multiple speakers) Sounds good to

me.

Operator

9

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

Steve

Tusa, JPMorgan.

David Farr - Emerson Electric Co. - Chairman, CEO, President

There is

a precision cooling aspect in here, in case you want to talk about

HVAC.

Steve Tusa - JPMorgan - Analyst

I always

like to talk of HVAC, but let's stick to the financials for this one, maybe. So

what is the EBIT number? I mean, I guess I could back into it. The $0.10 was

something a little bit less than what we would have initially expected, so maybe

you could just walk us from EBIT down to that $0.10?

David Farr - Emerson Electric Co. - Chairman, CEO, President

Steve,

I'm not going to give you that level of detail right now. We will do that in

February.

I'm not

going to back in -- I mean, this is a public company. They will be announcing

their quarter. You'll be able to get their information. I mean, at this point in

time, I don't want to get into any more detail. I mean, I've given you the EPS

dilution.

And as

I've said, when we come back out and announce our earnings in February, this

deal will be closed. We can give you a little bit more detail around that, even

when we have our New York session. I think you've got enough right now you can

work around those numbers, and I appreciate that.

Steve Tusa - JPMorgan - Analyst

Okay. So,

from a -- but from a, like, I guess a return-on-capital perspective, what's the

- -- what's kind of the hurdle rate you are thinking here? Three years

out?

David Farr - Emerson Electric Co. - Chairman, CEO, President

It's

going to be a little longer. When I talk about our strategic marquee deals, it

takes us typically a little bit -- more like a five, six, seven type of years.

This is not a -- I mean, if you think about a little bolt-on acquisition, I can

do that in a one- or a two-year, three-year time period. This is a little bit

different situation here.

Steve Tusa - JPMorgan - Analyst

Okay, and

what historically on those bolt-ons do you usually target, just for

background?

David Farr - Emerson Electric Co. - Chairman, CEO, President

If you

look at our return on total capital of the years we're talking, typically

anywhere from 13% to 18% to 20%. This one is going to be more down in the lower

double-digit level.

Steve Tusa - JPMorgan - Analyst

Okay, and

I noticed that APCC is a customer of theirs, I think.

Unidentified Company Representative

10

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

Yes, they

are. (multiple speakers)

Steve Tusa - JPMorgan - Analyst

Are they

- -- I know they're not a top 10, but are they a sizable customer and are you

worried about any kind of loss of business there, given that you guys are big

competitors?

David Farr - Emerson Electric Co. - Chairman, CEO, President

Oh,

they're a competitor of ours?

Steve Tusa - JPMorgan - Analyst

I think

so.

David Farr - Emerson Electric Co. - Chairman, CEO, President

I can't

- -- I forgot about that. It's less than $5 million, Steve.

Steve Tusa - JPMorgan - Analyst

And then,

one last question, I guess you guys have no obligation to update your guidance

at this stage of the game, right? Even though the quarter's

closed?

David Farr -

Emerson Electric Co. - Chairman, CEO, President

No

comment.

Steve Tusa -

JPMorgan - Analyst

Okay. Had

to try. Thanks.

David Farr - Emerson Electric Co. - Chairman, CEO, President

Good try.

Nice backing. You're a damned troublemaker, Steve. Hello, Deane.

Operator

Deane

Dray, FBR.

Deane Dray - FBR - Analyst

Good

morning, everyone. Dave, could you describe or give us some color on Avocent's

market share, maybe by geography. You know, when I first looked at the deal, I

was expecting you to say that this is more of a geographic play, where you could

take Avocent into markets outside the U.S.. But it looks like they've already

made some progress there. So, what's their market share by geography and what's

really the opportunity?

David Farr - Emerson Electric Co. - Chairman, CEO, President

11

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

If you

look at -- I did give -- if you look at the KVM, which is the key part of their

company, we gave you the specific market share.

In the

Americas, they are 45% -- 45%, and Europe, they are probably 42%. I'm looking

off this chart here. And in Asia, they are probably around 50%.

I

personally believe that if I look at the capabilities, I think that we could do

more both in Europe and Asia-Pacific with our strong global infrastructure. The

United States, we both have a very good presence today.

I don't

see -- that's not -- this is a game about expanding the market more than trying

to bolt on anything. Let's say, okay, let's expressly change the market share or

the cost structure. So I personally believe that the game for us is expand that

market, and then Europe and Asia are two markets that I think, and Latin

America, that I think that we can expand our presence quite

significantly.

Deane Dray - FBR - Analyst

And then,

just to cite expectations, is Emerson's shopping cart full at this point? You're

still in the acquisition hunt? Was it the marquee deal? What's the

outlook?

David Farr - Emerson Electric Co. - Chairman, CEO, President

We are

still in the acquisition hunt. We got a balance sheet that can deal with this

and we generate, as you know, we generate a lot of cash flow. We had a good year

in 2008, in 2009. So this is not the end of the game for us.

I think

you're going to continue to see us do acquisition. We closed close to $1 billion

in 2000 -- fiscal 2009. Our goal right now, as we showed the finance committee,

is that we'll be somewhere in the $1.5 billion to $2 billion range for 2009. And

if I can do better, I will do better.

Operator

Christopher

Glynn, Oppenheimer & Co..

Christopher Glynn - Oppenheimer & Co. - Analyst

Just

looking for some commentary on the key competitive dynamics in your legacy UPS

and cooling, and the opportunity to drive some incremental share there with the

complete offering. How are you looking at that?

David Farr - Emerson Electric Co. - Chairman, CEO, President

If you

look at Avocent globally, [besides] the quick remark I made with Steve Tusa

about the APC Schneider. APC Schneider globally are number one in the

marketplace.

We are

number two globally in the marketplace, and I fundamentally believe that this

will allow us to offer a better package in certain populations, to be able to

gain some share for the whole product offering, be it precision cooling, be it

the UPS line, and our couple of other areas.

So I look

at this as a positive from the standpoint of the next five to seven years, that

we could gain some additional market share in our core -- what we call the

network power infrastructure business today. That is something I look at this

from a growth standpoint. If I expand this marketplace, then we can do a lot

more.

Operator

Michael

Schneider, Robert W. Baird & Company, Inc..

12

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

Michael Schneider - Robert W. Baird & Company, Inc. - Analyst

I guess

just one strategic question. If you look at the slide, and it shows how you lie

left of the technology companies and Avocent lies in the center? Is there an

obsolescence or integration risk here that servers ultimately incorporate this

KVM technology, and you actually now are competing with your IT

customers?

David Farr - Emerson Electric Co. - Chairman, CEO, President

They do

already, Mike. If you look into this today, we supply all the server guys and

some of them will embed it -- they embed the KVM right in the server. Some of

them do not.

So we

already have today -- we are the leader of both of them, from an embedded

standpoint and a standalone standpoint. Or not we, Avocent is, I'm sorry.

Avocent is.

So this

is an issue they have been working with and they are very good at this. That's

why the HP, IBM, and Dell relationships are so strong. Because today, many of

the servers are sold with the KVM embedded right in it. So this is going to

allow us to be even closer to these customers.

Michael Schneider

-

Robert W. Baird & Company, Inc. - Analyst

I guess,

a different way of asking the question is, have any of these customers developed

their own chipsets or integrated software such that --

David Farr - Emerson Electric Co. - Chairman, CEO, President

Yes.

Michael Schneider - Robert W. Baird & Company, Inc. - Analyst

--

Avocent has been carved out of the process?

David Farr -

Emerson Electric Co. - Chairman, CEO, President

We do

have some customers that have done that, but we have been able to work with them

very closely and we have not lost -- or Avocent has not lost a lot from that

standpoint.

Again,

this is a situation where Avocent is the best in class in the technology and

capability. We're faster. The obsolescence is not a big issue, and we're able to

work right with our key customers.

It's not

something -- what I would say that you see the OEMs are going to be threatened

by this. And they're not going to be threatened by us. Because we're not going

to be a computer company. Were not going to get into the servers. We're not

going to get into that.

What we

want to do is create the capability, the information capability to help the HPs

and help the IBMs and help the Dells and so on do more with this knowledge and

communicate across that whole infrastructure base. So the KVM is the key vehicle

to that because it is that smart intelligence, and in some cases, some of the

computer companies have done some of their own, but in most cases they're still

very strongly tied with Avocent.

Michael Schneider - Robert W. Baird & Company, Inc. - Analyst

And out

of curiosity, how much were you buying from Avocent?

David Farr - Emerson Electric Co. - Chairman, CEO, President

13

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

We bought

a little, not a whole lot. But a little. If you go to our data centers, you see

their product across our business. It's not -- it's not meaningful in the sales

scheme.

Michael Schneider

-

Robert W. Baird & Company, Inc. - Analyst

And then,

just fiscal 2011, because of the aggressive amortization, will it be dilutive as

well on a GAAP basis?

David Farr - Emerson Electric Co. - Chairman, CEO, President

Yes, it

will be.

[E less].

E less.

Operator

[Judy

Delgado].

Judy Delgado Analyst

Actually,

the last question touched on the OEM customers that Avocent has, and I was

really wondering if they would be affected. I see the top four have over 30% of

the revenues there.

David Farr - Emerson Electric Co. - Chairman, CEO, President

Yes, we

don't -- we have a very good relationship with all of these OEMs, and they are

very important to us, strategically, too. And if you look at our top 20 customer

list, you see these same OEMs pop into it. So I don't think we're going to have

a big strategic issue there.

We'll

reach out and work with these customers, and Avocent has had a very good

relationship and we've got a very good relationship, so we feel very comfortable

with that, and there's not any big issue there.

Judy Delgado Analyst

Okay. And

on another note, just curious if there was a -- you were involved in a process

to get to this point. You mentioned earlier on the call that you've been working

on the deal for quite some time. Could you add to that?

David Farr - Emerson Electric Co. - Chairman, CEO, President

No.

You'll see when the material comes out that we reached out, and I've had

conversations with the Board off and on for a couple of years.

Judy Delgado Analyst

So you

weren't part of a strategic process?

David Farr - Emerson Electric Co. - Chairman, CEO, President

No. No, I

initiated it.

Operator

14

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

(Operator

Instructions). Martin Sankey, Neuberger Berman, LLC.

Martin Sankey - Neuberger Berman, LLC - Analyst

My

question is -- in looking at, a casual glance at Avocent's income statement over

the last several years, it seems like profitability peaked in 2006, and then if

you look at the progression since that time, gross margin and R&D expense

are pretty stable as a percentage of sales. But the SG&A, excluding R&D,

ballooned.

Could you

talk to us as to what you think was happening at the company? And what that

might represent as an opportunity for Emerson?

David Farr - Emerson Electric Co. - Chairman, CEO, President

I think

the key issue there, Martin, is they made a decision. They bought a company

called LANDesk, and they've made -- they've been making some significant

investments in that acquisition.

And I

think that as they tried to take that business and go global with it, and they

tried to create their own little solutions capability, so they've been investing

quite aggressively, both in the technology and the global network.

And I

think what you're going to see with the combination of Emerson and Avocent, we

will be able to leverage -- I think that will be the key leverage point for our

standpoint is we are going to globalize it from a best cost-structure

standpoint, but most importantly, we are going to tie it in tighter to our

organization which we have around the world, both in Asia and Europe and Latin

America.

So I

think that will be our point of attack right there, and I think that we'll

strengthen their organization and also strengthen our whole solutions

capability.

They were

trying to do it by themselves. You're looking at a $600 million or $700 million

company trying to do the same thing as a $20 billion company like Emerson does,

and it's a lot more challenging, as you can imagine.

With

that, I need to wrap it up here. I have -- I want to go back to my Board

meeting. I appreciate your time today. This is a very strategic acquisition for

us and I truly appreciate everyone joining us. And if you have any questions,

I'm sure you'll be calling Lynne. And look forward to seeing you all in the near

future. Thank you very much.

Operator

Thank

you. Ladies and gentlemen, this concludes the Emerson agreement to acquire

Avocent Corporation conference call. If you'd like to listen to a replay of

today's conference, please dial 303-590-3030 or 800-406-7325, and enter the

access code 417-0272, followed by the pound sign. (Operator Instructions). ATT

would like to thank you for your participation, and you may now

disconnect.

15

Final Transcript

|

Oct.

06. 2009 / 11:00AM ET, EMR - Emerson Electric to Acquire Avocent

Corporation

|

|

DISCLAIMER

Thomson

Reuters reserves the right to make changes to documents, content, or other

information on this web site without obligation to notify any person of

such changes.

In

the conference calls upon which Event Transcripts are based, companies may

make projections or other forward-looking statements regarding a variety

of items. Such forward-looking statements are based upon current

expectations and involve risks and uncertainties. Actual results may

differ materially from those stated in any forward-looking statement based

on a number of important factors and risks, which are more specifically

identified in the companies' most recent SEC filings. Although the

companies mayindicate and believe that the assumptions underlying the

forward-looking statements are reasonable, any of the assumptions could

prove inaccurate or incorrect and, therefore, there can be no assurance

that the results contemplated in the forward-looking statements will be

realized.

THE

INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF

THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO

PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS,

OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE

CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY

OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR

OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON

THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE

APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S

SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER

DECISIONS.

©

2009 Thomson Reuters. All Rights Reserved.

|

ADDITIONAL

INFORMATION AND WHERE TO FIND IT

THIS

TRANSCRIPT IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE AN OFFER

TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL AVOCENT COMMON STOCK. THE

SOLICITATION AND OFFER TO BUY AVOCENT COMMON STOCK WILL ONLY BE MADE PURSUANT TO

A TENDER OFFER STATEMENT ON SCHEDULE TO (INCLUDING THE OFFER TO PURCHASE AND

RELATED MATERIALS) THAT GLOBE ACQUISITION CORPORATION, A WHOLLY-OWNED SUBSIDIARY

OF EMERSON, INTENDS TO FILE WITH THE SECURITIES AND EXCHANGE COMMISSION (SEC).

AVOCENT’S INVESTORS ARE URGED TO READ THESE MATERIALS, ANY AMENDMENTS TO THESE

MATERIALS, AND ANY OTHER DOCUMENTS RELATING TO THE TENDER OFFER THAT ARE FILED

WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE PRIOR TO

MAKING ANY DECISIONS WITH RESPECT TO THE OFFER SINCE THEY WILL CONTAIN IMPORTANT

INFORMATION, INCLUDING THE TERMS AND CONDITIONS OF THE OFFER. INVESTORS MAY

OBTAIN A FREE COPY OF THESE MATERIALS (WHEN AVAILABLE) AND OTHER DOCUMENTS FILED

BY EMERSON WITH THE SEC AT THE WEBSITE MAINTAINED BY THE SEC AT WWW.SEC.GOV. THE

OFFER TO PURCHASE AND RELATED MATERIALS MAY ALSO BE OBTAINED (WHEN AVAILABLE)

FOR FREE BY CONTACTING EMERSON AT 8000 WEST FLORISSANT AVENUE, ST. LOUIS,

MISSOURI 63136, (314) 553-2197.

16

|

[OBJECT OMITTED]

Avocent Acquisition

David N. Farr

October 6, 2009

Safe Harbor Statement:

Our commentary and responses to your questions may contain forward-looking

statements and Emerson undertakes no obligation to update any such statement to

reflect later developments. Information on factors that could cause actual

results to vary materially from those discussed today is available in the most

recent Annual Reports on Form 10-K as filed by Emerson and Avocent with the SEC.

Non-GAAP Measures:

In this call we will discuss some non-GAAP measures (denoted with *) in talking

about Avocent's performance, and the reconciliation of those measures to the

most comparable GAAP measures is contained within this presentation.

|

|

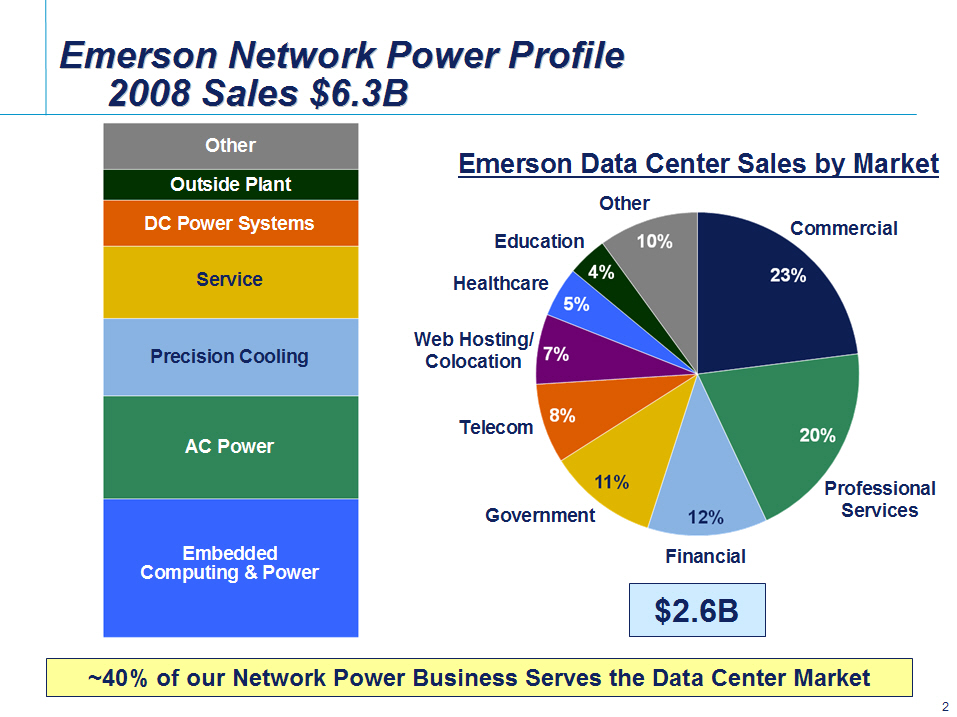

Emerson Network Power Profile

2008 Sales $6.3B

Emerson Data Center Sales by Market

4% 10% 23% 20% 12% 11% 8% 7% 5%

Service

Precision Cooling

Outside Plant

DC Power Systems

AC Power

Embedded

Computing @ Power Other

Education

Healthcare

Web Hosting/

Colocation

Professional

Services

Telecom

Government

Financial

Commercial

$2.6B

~40% of our Network Power Business Serves the Data Center Market

|

|

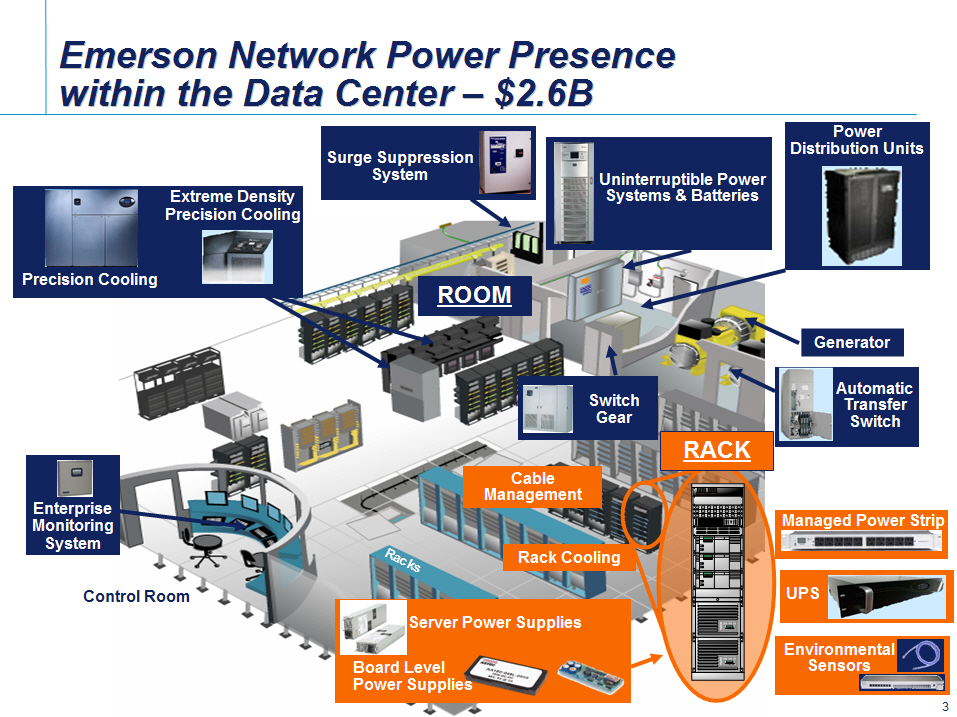

Emerson Network Power Presence within the Data Center - $2.6B ROOM RACK |

|

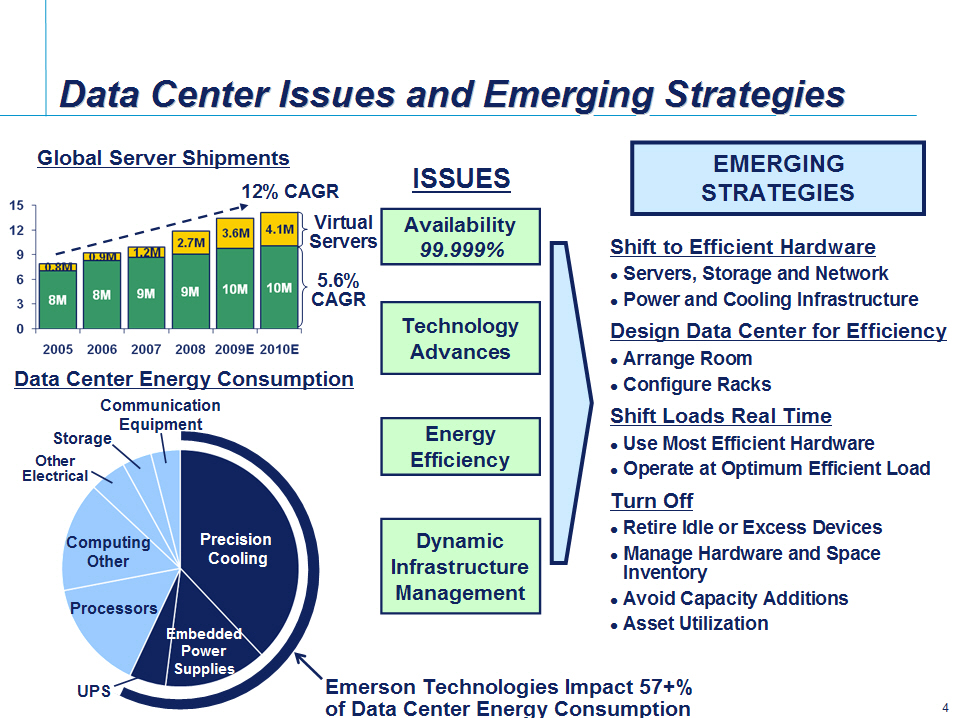

Data Center Issues and Emerging Strategies

Global Server Shipments

12% CAGR Virtual

Servers

5.6%

CAGR

Data Center Energy Consumption

Communication Processors

Storage Equipment

ISSUES

Other

Electrical Availability

Computing 99.999%

Other Technology

Advances

Energy

Efficiency

Dynamic

Infrastructure

Management

EMERGING STRATEGIES

Shift to Efficient Hardware

o Servers, Storage and Network

o Power and Cooling Infrastructure

Design Data Center for Efficiency

o Arrange Room

o Configure Racks

Shift Loads Real Time

o Use Most Efficient Hardware

o Operate at Optimum Efficient Load

Turn Off

o Retire Idle or Excess Devices

o Manage Hardware and Space Inventory

o Avoid Capacity Additions

o Asset Utilization

Emerson Technologies Impact 57+%

of Data Center Energy Consumption

|

|

Data Center Users Group Survey Results

May 2005 Nov 2007 May 2009

Energy Efficiency Focus Continues to Intensify, and It's

One of Emerson's Core Technologies and Capabilities

|

|

Data Center Infrastructure Management Four Categories Of IT End User Needs

Input from IT End Users

o Optimization Of Energy Usage & Related Operating Costs

o Predictive Diagnostics of Support Infrastructure o Remote Monitoring &

Analysis of Critical Infrastructure

o Capacity Management Tools - Management of Power, Cooling, Connectivity &

Space Based on IT Device Load

o Workflow Management (Add, Change, Decommission) Process Tools

o Visualization & Mapping Tools for Data Center Environment

o Configurator Tools that Recommend Support Infrastructure Designs Based on

IT Device Inputs

o Room & Rack Layout Tools

o Symbol Library of IT & Support Infrastructure Devices

o Real-Time Monitoring of UPS, Precision Cooling, Power Distribution Unit,

Power Strip, Rack & Environmental Devices

Capabilities

Needed

Performance

Optimization

Asset

Management

Configuration

Real-Time

Monitoring

|

|

IT Infrastructure Management Becoming Increasingly Critical Area of Data Centers

Performance Solutions Opportunity

IT

Optimization Building

Management

Mngmt

Companies &

Co's

Asset Server OEMs

Management NOW!

Configuration

Real-Time

Monitoring

Building Room Rack IT Device Software

-------- ---- ---- --------- --------

(Gensets, (UPS, Cooling) (Power Strip, (Servers, (Applications)

HVAC) KVM Switch) Storage)

There is an Unmet Need to Deliver a Comprehensive (Highly Integrated) Solution

Set for Infrastructure Management - Emerson is Well Positioned to Do this with

the Addition of Avocent

|

|

Rack Building Blocks & Terminology

Rack

Device Function Manufacturer

Rack Secure Devices Emerson

Power Strip Power Distribution Emerson

KVM Switch Infrastructure Control Avocent

UPS Reliable Power Emerson

Router Data Routing & Cisco, Juniper,

Delivery Alcatel

Network Switch Network Connection Netgear, Cisco

Drawer Local Access/Control Emerson

Server Computing HP, Dell, IBM,

Sun, Others

Storage Memory EMC, Seagate,

Western Digital

Precision Temperature & Emerson

Cooling Humidity

Extends Data Center Hardware Visibility with Access to IT Device

Operating and Performance Information 8

|

|

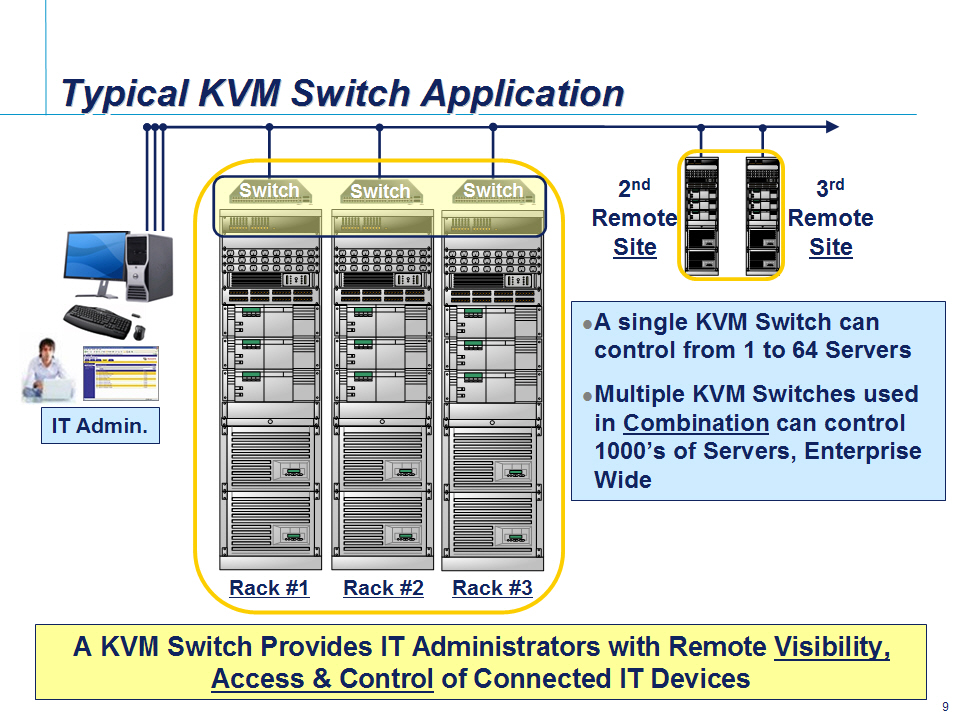

Typical KVM Switch Application

2nd 3rd

Remote Remote

Site Site

o A single KVM Switch can control from 1 to 64 Servers

o Multiple KVM Switches used in Combination can control 1000's of Servers,

Enterprise Wide

Rack #1 Rack #2 Rack #3

A KVM Switch Provides IT Administrators with Remote Visibility,

Access & Control of Connected IT Devices

|

|

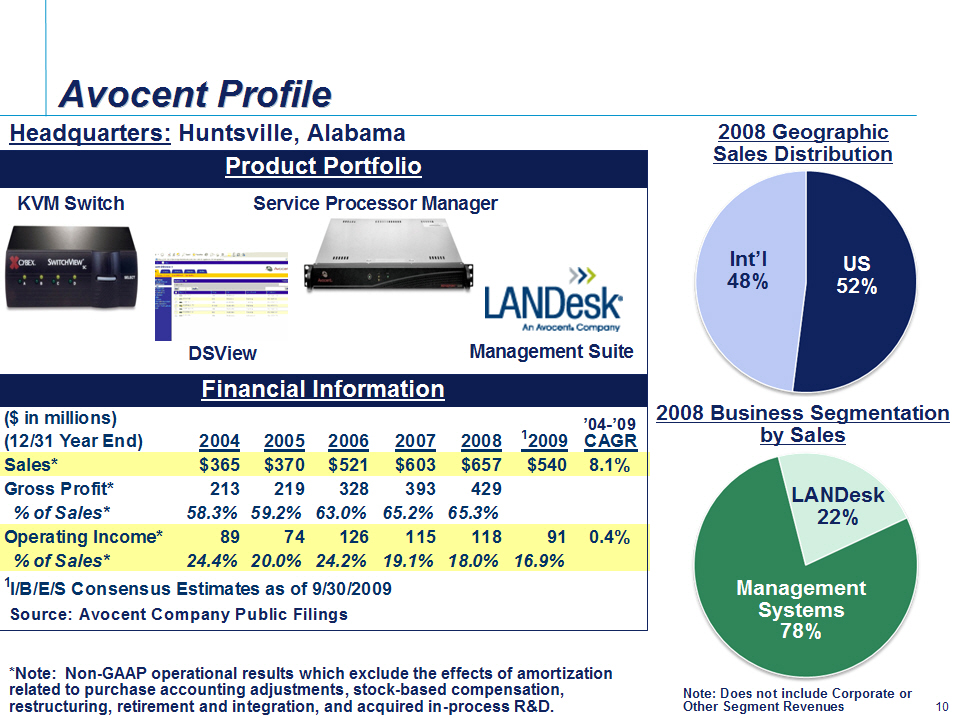

Avocent Profile

Headquarters: Huntsville, Alabama

Product Profile

KVM Switch Service Processor Manager

DSView Management Suite

($ in millions) Financial Information

(12/31 Year End) '04-'09

2004 2005 2006 2007 2008 (1)2009 CAGR

---- ---- ---- ---- ---- ------- ----

Sales* $365 $370 $521 $603 $657 $540 8.1%

Gross Profit* 213 219 328 393 429

% of Sales* 58.3% 59.2% 63.0% 65.2% 65.3%

Operating Income* 89 74 126 115 118 91 0.4%

% of Sales* 24.4% 20.0% 24.2% 19.1% 18.0% 16.9%

(1)I/B/E/S Consensus Estimates as of 9/30/2009

Source: Avocent Company Public Filings

*Note: Non-GAAP operational results which exclude the effects of amortization

related to purchase accounting adjustments, stock-based compensation,

restructuring, retirement and integration, and acquired in-process R&D.

2008 Geographic

Sales Distribution

Int'l US

48% 52%

2008 Business Segmentation

by Sales

LANDesk

22%

Management

Systems

78%

Note: Does not include Corporate or

Other Segment Revenues

|

|

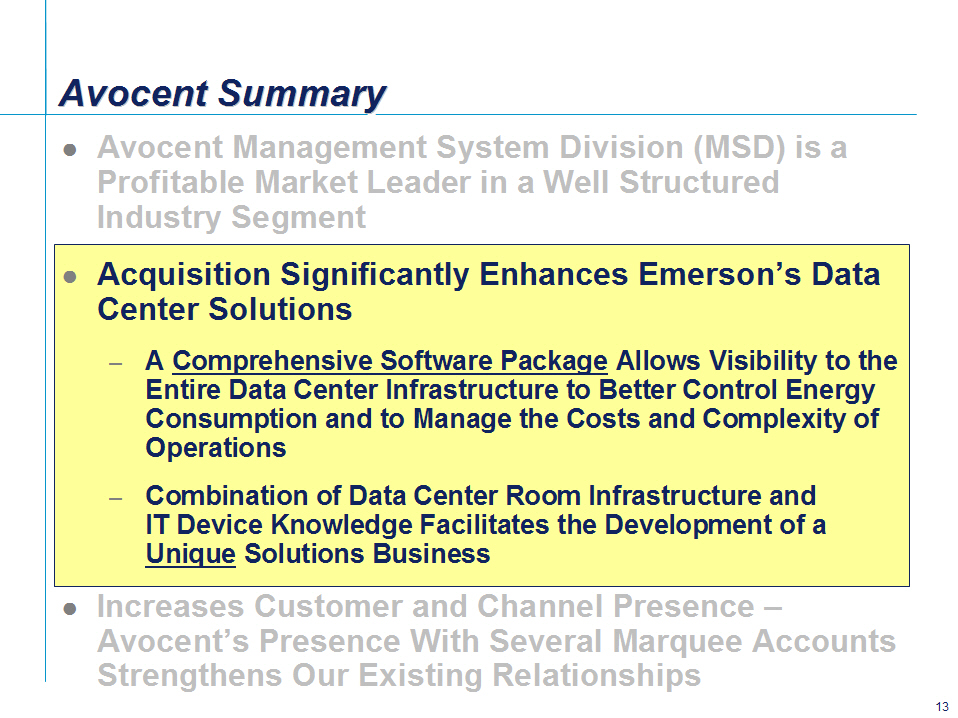

Avocent Summary

o Avocent Management System Division (MSD) is a Profitable Market Leader in a

Well Structured Industry Segment

o Acquisition Significantly Enhances Emerson's Data Center Solutions

o Increases Customer and Channel Presence - Avocent's Presence With Several

Marquee Accounts Strengthens Our Existing Relationships

|

|

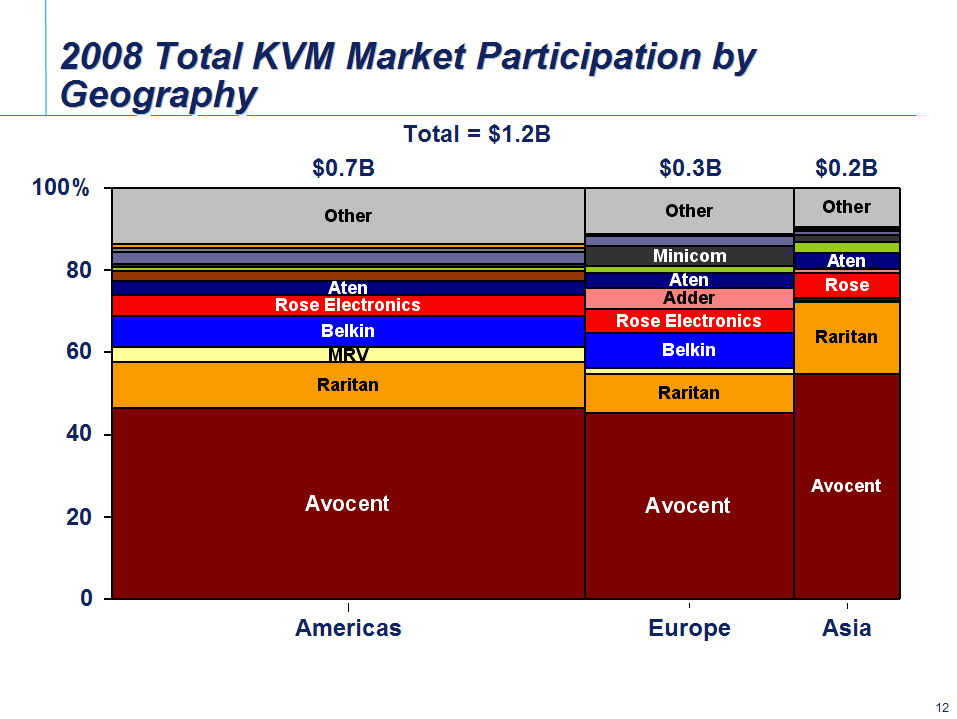

2008 Total KVM Market Participation by Geography

Total = $1.2B

$0.7B $0.3B $0.2B

Aten

Rose Electronics

Belkin

MRV

Raritan

Avocent

Americas Europe Asia

|

|

Avocent Summary

o Avocent Management System Division (MSD) is a Profitable Market Leader in a

Well Structured Industry Segment

o Acquisition Significantly Enhances Emerson's Data Center Solutions

- A Comprehensive Software Package Allows Visibility to the Entire Data

Center Infrastructure to Better Control Energy Consumption and to

Manage the Costs and Complexity of Operations

- Combination of Data Center Room Infrastructure and IT Device Knowledge

Facilitates the Development of a Unique Solutions Business

o Increases Customer and Channel Presence - Avocent's Presence With Several

Marquee Accounts Strengthens Our Existing Relationships

|

|

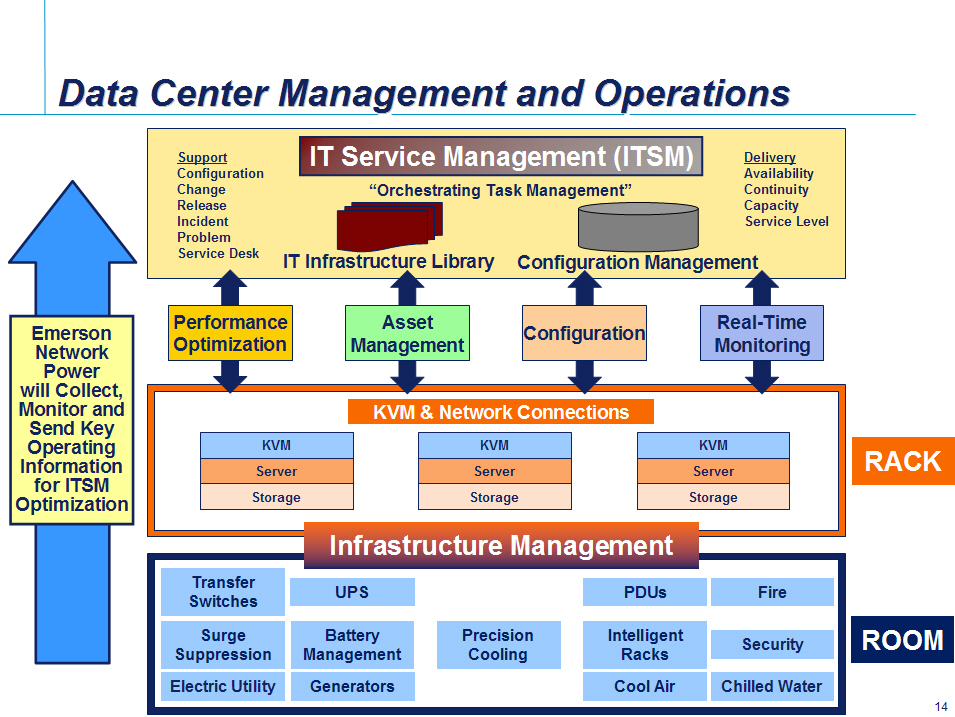

Data Center Management and Operations

IT Service Management (ITSM)

RACK ROOM

Emerson Network Power will Collect, Monitor and Send Key Operating Information

for ITSM Optimization

Support Delivery

Configuration Availability

Change "Orchestrating Task Management" Continuity

Release Capacity

Incident Service Level

Problem

Service Desk IT Infrastructure Library Configuration Management

Performance Asset Configuration Real-Time

Optimization Management Monitoring

KVM KVM KVM

Server Server Server

Storage Storage Storage

Infrastructure Management

Transfer UPS PDUs Fire

Switches

Surge Battery Precision Intelligent Security

Suppression Management Cooling Racks

Electric Utility Generators Cool Air Chilled Water

|

|

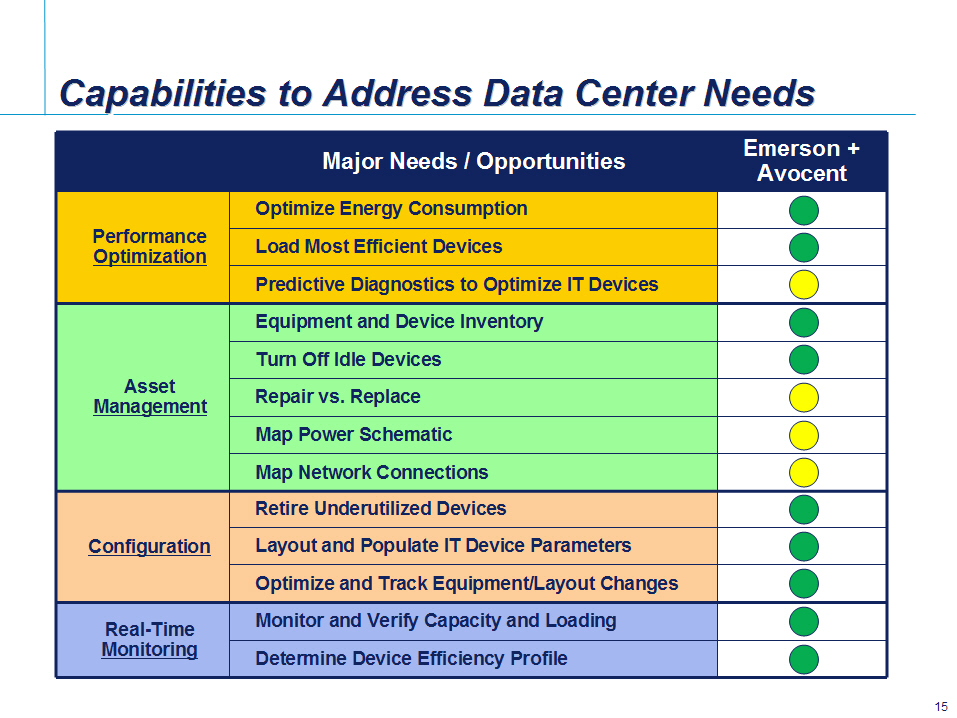

Capabilities to Address Data Center Needs

Emerson *

Major Needs / Opportunities Avocent

Optimize Energy Consumption

Performance Load Most Efficient Devices

Optimization Predictive Diagnostics to Optimize IT Devices

Equipment and Device Inventory

Turn Off Idle Devices

Asset Repair vs. Replace

Management Map Power Schematic

Map Network Connections

Retire Underutilized Devices

Configuration Layout and Populate IT Device Parameters

Optimize and Track Equipment/Layout Changes